How to Obtain a Reduced Guaranty Fee on USDA Business and Industry Loans

February 16, 2021

#Loan Guide | #FY2021 | #Eligibility

In talking to several USDA lenders around the country, I have found not many know that reduced guarantee fees exist if one of several scenarios are met in section, 5001.454(d)(1-5). These regulations are detailed below and includes references as to where to finds the supporting data to qualify for each.

In bold is a part of the USDA RD5001 code with an explanation of that code found by clicking on the number.

§5001.454 Guarantee fee.

(…)

(d) Reduced fee. Subject to annual limits set by the Agency and published in an annual Federal Register document, the Agency may charge a reduced guarantee fee if requested by the lender when the borrower's project meets any one of the following criteria:

This list can found at https://eig.org/dci.

The Economic Innovation Group was founded by Sean Parker, John Lettieri, and Steve Glickman and is a bipartisan public policy organization that combines innovative research and data-driven advocacy to address America’s most pressing economic challenges.

One of the maps they created to visualize economic distress and prosperity across the US was the Distressed Community Index (DCI). This map:

“examines economic well-being at the zip code level in order to provide a detailed view of the divided landscape of American prosperity. When we consider the health of the U.S. economy only in aggregate terms, we miss out on the textured — and deeply uneven — story of how national growth and prosperity lift up, or leave behind, individual communities and the residents who call them home. The DCI is therefore an attempt to understand the spatial distribution of U.S. economic well-being. It is a lens through which we can evaluate where and for whom the country truly lives up to its promise as a land of opportunity.”

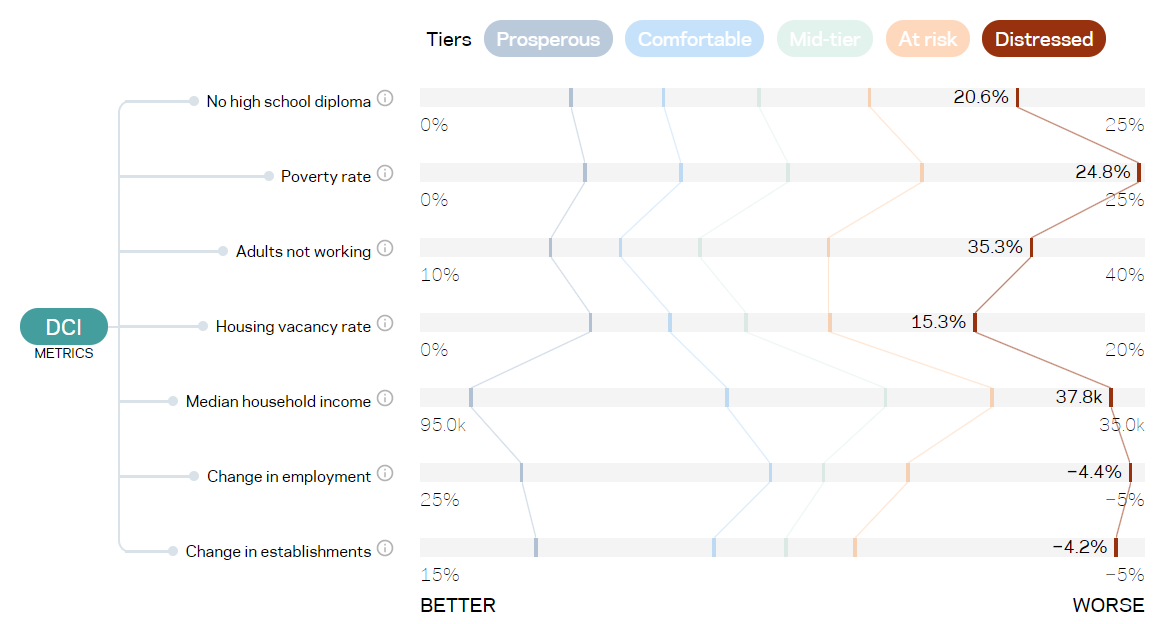

The DCI takes into account seven metrics and five tiers. Those seven metrics are:

- No High School Diploma: The share of the population age 25 and older who lack a high school diploma or equivalent.

- Poverty Rate: The share of individuals living below the federal poverty line.

- Adults not Working: The share of the population age 25 to 54 not working (i.e. either unemployed or not in the labor force).

- Housing Vacancy Rate: The share of housing units that are vacant, adjusted for recreational, seasonal, or occasional use vacancies.

- Median Household Income: Median household income as a percent of metro area or state median household income.

- Change in Employment: The change from 2014 to 2018 in the number of employees working in the geography.

- Change in Establishments: The change from 2014 to 2018 in the number of establishments located in the geography.

The five tiers are Prosperous, Comfortable, mid-tier, at-risk, and distressed. The chart below shows how each metric aligns with the five tiers.

To obtain a 1% Guaranty Fee the project must be in a community shaded in red on the map, found at https://eig.org/dci/interactive-map. The map shows a zip code view and a county level view. The new 5001 regulations do specify which one to use so I would personally use the zip code view as there are more opportunities.

The fourth edition of their report can be found at https://eig.org/dci/report

This information can be conveniently found on Google by following this link. They get their data from the U.S. Census Bureau and graph it so it can be easily seen.

Note, three decennial censuses are the period from 1990 Census to the 2010 Census. You will need to look at data from 1990 – 2010 as they cover the preceding 10 years.

You can use the left column, pictured to the right to find the data you need for your project by completing the following:

- In the top section choose population

- In the bottom section unselect the United State option by clicking the checked box next to United States

- Find the State your project is in and click the arrow to the left to expand the selection.

- Once expanded find the County your project is in and click the arrow to the left to expand the selection.

- Shown now will be the cities of the County. If yours is listed select that city by clicking the box and the data will load into the graph. If your city is not listed choose the County level data by selecting that box next to the county.

I would screen shot this map and include with your application if you are applying for a reduced guaranty.

You can use the slider at the bottom of the graph to select the years you want to see then screen shot the graph

This data was hard to find but there is a very nice spreadsheet with all of the poverty and population can be downloaded and sorted by county. Remember, you are looking for 1990-2000 levels. This IS NOT an average, both numbers have to be above 20% to qualify.

Note, this spreadsheet has MACROS embedded to make the nice dashboard on the first page.

This information can be found at: https://www.fema.gov/disasters/year.

Choose the state your project is in and the year which must be within 24 months of the application date. For declaration type you will need to choose Major Disaster Declaration.

NOTE, I have been told by several USDA Offices that COIVD-19 does not count as a major disaster. While I have a strong disagreement about the disastrous nature of COVID, I can understand their stance as all loans would receive reduced funding.

US Unemployment Rate Link: https://www.bls.gov/charts/employment-situation/civilian-unemployment-rate.htm

State Unemployment Link: https://www.bls.gov/web/laus/laumstrk.htm

County Level .txt File Link: https://www.bls.gov/web/metro/laucntycur14.txt

BLS Tables: https://www.bls.gov/lau/tables.htm

This information can be found at: https://biamaps.doi.gov/.

Once at the site, open the Map U. S. Domestic Sovereign Nations: Land Areas of Federally-Recognized Tribes.

There are specific regulations that define this which can be found at 5001.105(b)(15)(i) of which A-D are detailed below. These rules cover a wide range of projects covering the sale locally sourced food and the providing foods for underserved populations. If the project meets any of these criteria it would be eligible for a lower guaranty fee as well as be eligible in an ineligible area.

- A. Expands or preserves the availability of staple food in underserved areas with moderate and low-income populations by maintaining or increasing the number of retail or institutional outlets that offer an assortment of healthy perishable foods and staple food items;

- B. The project will create or retain quality jobs for low-income residents of the community.

- C. A significant amount of the food is locally or regionally produced and sold; and

- D. Includes an appropriate agreement with retail and institutional clients to inform consumers that they are purchasing or consuming locally or regionally produced agricultural food products.

See #2 above for explanation.

Value-added products are defined by USDA as having:

- A change in the physical state or form of the product (such as milling wheat into flour, making strawberries into jam, wood into wood pellets/furniture, cut and packaged flowers).

- The production of a product in a manner that enhances its value (such as organically produced products).

- The physical segregation of an agricultural commodity or product in a manner that results in the enhancement of the value of that commodity or product (such as an identity preserved marketing system).

This section is newer for the USDA B&I and CF loans as the Agricultural Improvement Act and did not pass until December 2018. For loans that align with a City or Municipality Community Investment Plan and in is a rural area. The text below is clipped from the Act under section 6401.

Section 6401

"(a) IN GENERAL—In the case of any program under this title or administered by the Secretary, acting through the rural development mission area, as determined by the Secretary (referred to in this section as a ‘covered program’), the Secretary shall give priority to an application for a project that, as determined and approved by the Secretary— (1) meets the applicable eligibility requirements of this title or the other applicable authorizing law; (2) will be carried out in a rural area; and (3) supports the implementation of a strategic community investment plan described in subsection (d) on a multisectoral and multijurisdictional basis, to include considerations for improving and expanding broadband services as needed.”

(---)

"(d) STRATEGIC COMMUNITY INVESTMENT PLANS.— (1) IN GENERAL.—The Secretary shall provide assistance to rural communities in developing strategic community investment plans. (2) PLANS.—A strategic community investment plan described in paragraph (1) shall include— (A) a variety of activities designed to facilitate the vision of a rural community for the future, including considerations for improving and expanding broadband services as needed; (B) participation by multiple stakeholders, including local and regional partners; (C) leverage of applicable regional resources; (D) investment from strategic partners, such as— (i) private organizations; (ii) cooperatives; (iii) other government entities; (iv) Indian Tribes; and (v) philanthropic organizations; (E) clear objectives with the ability to establish measurable performance metrics; (F) action steps for implementation; and (G) any other elements necessary to ensure that the plan results in a comprehensive and strategic approach to rural economic development, as determined by the Secretary.”

This information on economic development district is at https://eda.gov/edd/ and SECD is at https://www.rd.usda.gov/programs-services/strategic-economic-and-community-development.

The additional market for existing local businesses means that the borrower uses industry clusters in the same community as a substantial part of their product manufacturing or service delivery, or the borrower is part of a product chain where they are a substantial part of another local business’ product manufacturing or service delivery. The use of local janitorial or maintenance firms, for example, does not meet this criteria.

About Me

I have originated, underwritten, and managed USDA B&I and CF loans for 8 years. I obtained a MBA from Valdosta State University in 2012 and have more than 11 years of banking experience. In my free time I like to work on my farm, golf, and spend time with my wife and two kids (1 & 3).

Follow Me:

Linked-In